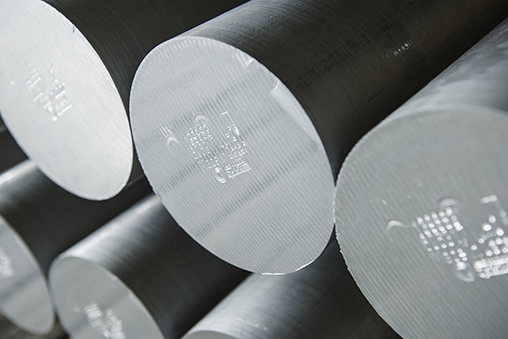

The 0.8% climb from the previous day was a result of the optimism over China’s assurance that it intends to follow through on its promise to cut aluminium production.

And though the closing price the next day, on 30 March, 2017, saw a drop to US$ 1956 per ton, the figure was still $300 more than what an equal amount of the metal was worth in March 2016, and ahead of the performance of other base metals in the market such as copper and zinc.

Market watchers and aluminium producers from Australia to America sighed with relief after months of uncertainty as to whether China would indeed cut its production, in order to address the increasing levels of smog in its industrial belt in the north of the country.

The relief comes in the wake of a Mid-March market tremor, caused by China’s Hongqaio, the world’s largest producer of the metal, when it announced that it aims to raise the annual capacity by around 15% this year if market recovery continues.

The Shandong-based firm had justified its move in the face of concerns over its existing over-capacity with assurances that it was a rational step, claiming that its production costs are much lower than other producers in the country, as it had its own power-plants and in-house upstream materials production facilities.

It seemed to be a valid argument, especially as the process of aluminium production typically runs up energy bills of up to 40% of the total operating costs.

The rationale, though, was also strong enough to leave the rest of the global market unsettled.

So the latest announcement by the Asian giant, detailing concrete measures to curb pollution by cutting capacity, seems to have put an end to the suspense - for the time being.

The question is - how significant is this announcement?

Quite significant, considering that China currently produces 50% of the world’s aluminium and that a mere 28 cities in the north of China account for a whopping 20% of the world’s total aluminium production. And an even bigger deal, when it is compared to the GCC’s combined global contribution of 10%.

The latest Chinese assurances spell out a detailed plan that authorities say will reduce winter smog in the north of the country. The proposal, which clearly outlines targets and deadlines, is aimed at curbing the output of pollution-inducing plants that operate on a small scale. Most of these plants either do not have proper licenses or appropriate emission treatment facilities.

According to officials, deadlines for these proposals, which will affect plants across Beijing, Taijing and the smaller cities of Hebei, Shanxi and Shandong, are to be met by October 2017 before the start of next winter.

Analysts predict that these measures, if executed in time, will be a game changer in the market, bringing potential upside risk to aluminium and leading to at least a 5% loss in the nation’s total aluminium production.

A loss that other players in the market, hope to capitalize on.

It is a hope based not solely on China’s assurances, but also on the metal’s increasing popularity across various industries.

Of late, soft drink and beverage bottling companies have been the latest entry into a long list of industries who seem to be waking up to the metal’s potential.

This year, Austrian based SKIWATER Beverages became the first European company to use Alumi-tek technology to bottle their drinks. The company has marketed its signature sparkling raspberry drink in aluminium bottles that combine the ‘portability, recyclability and freshness of a regular aluminium can’, with the screw cap ‘reseal ability’ of a bottle.

While such innovations are being tested out at a steady pace across the globe, the automotive industry remains the metal’s biggest market.

Companies like Novelis, for instance, have been quick to use the metal’s broad application base, to shift their strategy. Incidentally, the US based company, along with other smaller businesses, had recently exited the U.S. commodity foil business to concentrate on automotive aluminium products, following the ‘flooding’ of subsidized Chinese aluminium foil in the American market.

The move seems to have paid off. Currently, the company is the only automotive aluminium supplier with production capabilities in all three major auto-producing regions – Asia, Europe and North America – with products featured in 180 different vehicle models.

Meanwhile across the globe, the Japan Aluminium Alloy Refiners Association has forecast that the demand for die-casting aluminium alloy from the automotive industry would rise 1.5% year on year to 986,500 metric tonnes in fiscal 2017-2018.

Aluminum die castings are increasingly used in automobile production, as they are light weight, cheaper, can be produced in more numbers and more importantly, can be cast in one single piece, rather than being made up of components, thereby cutting costs.

Little wonder then, that the London Taxi Company has set up a state of the art 300 million pound, factory in the UK, to make 5000 aluminium bodied electric black taxis per year.

Plans are also underway to expand the factory into a globally connected research and development centre in electric vehicle power trains and lightweight aluminium body structures.

To sum up, after all the agony over China’s moves, one thing seems obvious.

smog + science = smiles in the aluminium market.

So the next time you hail a taxi in London, it might be worth remembering that the black cab pulling up in front of you is not just a much-loved symbol of British culture and heritage, but also reflects science’s enthusiastic nod of approval to the adaptability and strength of one of the most taken-for-granted metals on earth – aluminium.

References:

Financial times

Aluminium today

The Metal Casting

Infomine

Aluminium today

Aluminium today

Metal Bulletin

Newsnow