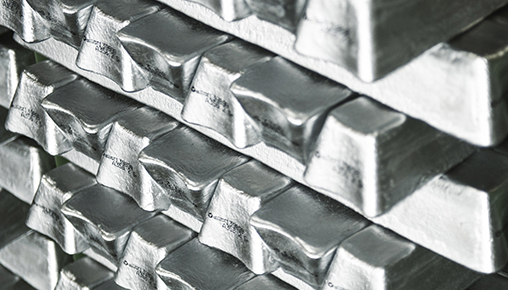

It outshone other industrial metals when it closed at US$ 1929 (per tonne) on 2nd March 2017, on the London Stock Exchange - an increase of 3.4% from Feb 26, and a leap of 15% from the start of the year.

This steady upward trend validates the predictions that where Aluminium is concerned, 2017 looks promising.

And there are reasons for such optimism.

The latest boost was in part, due to China’s decision to cut capacity after years of excess supply.

Another catalyst for the metal’s 20-month-high price, was the news that US authorities had seized an illegal aluminium stockpile, supposedly belonging to a Chinese business. The uneasiness resulting from the prospect of trade barriers to clamp down on companies who evade tariffs, pushed up the metal’s worth.

The metal’s strengthened market presence also appears to be a reaction to China’s efforts to curb the pollution belching out of its factories. As most industries are coal-dependent for energy, any decrease in the use of coal to reduce pollution, would automatically result in lower production, and in the short-term, increasing prices.

Yet another trigger seems to be the slow restart of Chinese smelters that were shut down in the past, as increasing production costs put off industrialists from taking risks.

The last decade saw the metal’s price yo-yoing, before beginning its slow and steady gain.

By 2015, the aluminium market had become increasingly tolerant to market variations and low prices, as manufacturers were quick to seize the opportunity offered by a supposedly artificial market environment, again, increasing its demand.

In fact, the demand for the light-weight metal has increased by 36% since 2009.

Global production of aluminium has seen a year-on-year increase of 6%, over a 6-year period, with 58 million tons being produced by the end of 2016, up from 42.4 million tons in 2010.

China’s growth in this demand-supply chain has been meteoric to say the least. The nation produced 11% of the world’s primary aluminium in 2000; today it produces more than half the global supply.

Lighter cars consume less fuel, and less fuel means less emissions. Photo: renewbyhydro - Getty/iStock

The automobile industry especially, in its race to build more energy-efficient cars, capitalized on these cheaper offerings from China. Lighter aluminium chassis made faster and more fuel-efficient cars possible and environmental-friendly electric cars, affordable.

The FAA's National Kit Evaluation Team (NKET) evaluated the entire CH 650 kit inside the Zenith Aircraft factory

The aviation and aero-space industries too, realized aluminium’s potential in building aircrafts that were fuel-efficient, had more capacity and left less emissions.

The latest adaptation of the metal can be seen in the Aeroscraft, a dirigible made up of aluminium and carbon frames. Its lightweight skeleton enables it to lift-off without a runway and can carry up to 65 tons of cargo, making it ideal to access disaster-hit areas and remote places such as far-flung villages in Canada, Siberia and the Arctic.

The future of the metal looks promising, as research and design labs around the globe build prototypes of aluminium solar panels, transparent alluminium alloys, aluminium air batteries and discover new applications in nanotechnology.

In fact, after years of concentrating on steel, iron and copper, the Age of Aluminium may have finally arrived.